Market Highlights & Commentary:

- INR likely to open weaker for the 2nd consecutive day around 72.20-72.25 as against yesterdays close of 71.88. Range for the day to be mixed between 71.90-72.40 with RBI intervention highly anticipated around 72.40-72.50+. Technically this move up may extend to 73.00 in coming days.

- We expect market to recover as it starts to look at soft crude; expected liquidity infusion and not so bad performance of BJP

- Shaktikanta Das has been appointed as new chief of RBI. Das is a former economic affair secretary and a current member o the Finance commission of India.

- Today India’s inflation-CPI is scheduled to be published at 5.30 pm which is likely to narrow down marginally on back of fall in oil prices. India’s consumer inflation has been seen an downward trend since last last 5 month (Refer image below) and latest reading is expected to be in a range of 3% to 3.3%

- USD traded strong against most of its rival currencies on back of rebound in U.S yield ahead of U.S inflation reading.

- GBP remained weaker for 2nd straight day amid of rising uncertainty over U.K PM May’s future and Brexit deal. If market talks are to be believed several key lawmaker have sent no confidence letter against May raising doubt about her future as U.K PM.

- No major change in oil price were seen and continued to trade at yesterdays levels around 60.82.

- This morning most of Asian and Emerging currencies are trading with strength, CNY is trading near to 6.9. Equities on other hand are mixed.

Technical Corner & strategy for the day:

- USDINR after yesterday move seems to be forming support above 72.00, if today price closes above these crucial level then possibility of 72.70-73.00 in near term cannot be ruled out.

- Exporters are suggested to take small part of long term hedge around 72.30-72.40 levels an importers may consider covering near term payment either below 72 or around 72.05-72.10.

- GBPINR currently is around 90.32 and at current levels seems to be trading under strong bearish environment with possibility of 89.00 or lower in coming days. If today GBPINR if closes below 90 levels then more weakness in highly anticipated.

- EURINR has yesterday tested 82.80 and currently seeing some retracement around 81.86. Price is likely to find support 81.70 and retest 82.80 in coming days.

Important Economic Data and Events (12.12.2018 to 14.12.2018):

- December 12: U.S & India’s inflation(CPI) for Nov’18

- December 13: ECB press conference

- December 14: India’s trade deficit & IIP for Nov’18 and RBI board meeting

Yesterday’s Market Recap:

- Yesterday remained among one of the most volatile day for INR which opened with major weakness at 72.46 against previous close of 71.34. RBI intervention helped INR to recover some loss and lose below 72 at 71.81 but price action movement suggested that more weakness is under way, possibility 72.70-73.00 coming future.

- The benchmark NSE opened with major weakness of 205 point but later recovered and closed with marginal gains.

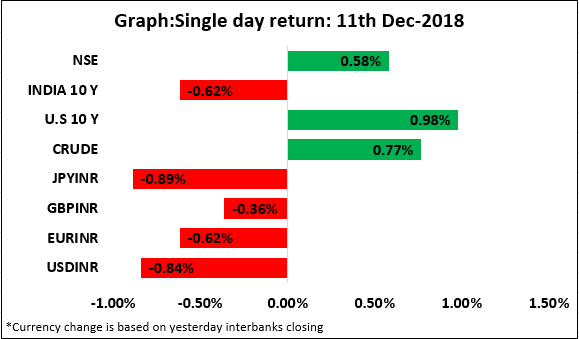

Market Movements & Performance: