INR at a crucial junction, What next?

Options hedging could be a blessing in disguise.

At current levels it is a dilemma for importer/exporter to hedge in forwards!

Free Q&A with Hedging Experts

Given the current USDINR volatility, are you in a dilemma weather to hedge forwards or not?

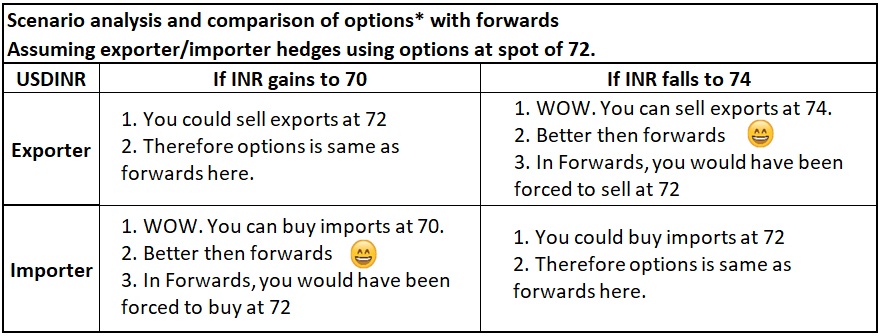

In such uncertain times, options could be a way to solve your dilemma.

Plain Options

How options work?

*The only cost of doing option is upfront payment of option premium to bank. It is approximately 50 paise per USD to buy option for one month at strike equal to ongoing spot rate. For more details, look below.

Exotic Options

(Seagull options, call spread, range forward, butterfly)

We may assist you on the following queries –

1. Do you know the actually cost charged by the bank/brokers?

2. Do you know how much you could lose?

3. Do you know what will be the cost of cancellation? Can you calculate it in a transparent way?

and on many more things, Just contact our Hedging Experts.

Frequently asked questions

What are the type of options?

There are many types of options. The most common are “Put” option and “Call” option. Put option is for Exporters whereas Call option is for Importers.

What determines options premium? and how can we reduce it?

Option premium is a function of strike price, period before expire, type of option and volatility in market. You may reduce period before expire or buy out of money option to reduce premium. Alternatively, you would have to opt for exotic options.

What are exotic options?

Options is a vast subject and has many variants of put and call option. Sophisticated market participants can create customized options by combing buy and sell leg of call and put options at various strike rates. Such combination of options is generally called exotic options. Exotic options carry significant risk and can be priced by sophisticated tools.

*Beware – Don’t use exotic options like seagull, etc, they lack transparency and are difficult to exit.