.

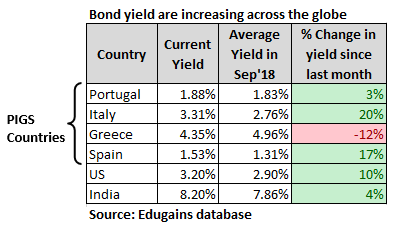

We find that in last few days, yield of 10 year Govt bonds are increasing across the countries and in each geography the reasons are different. In Europe it is uncertainty of Euro- zone itself because of crisis in Italy; in US it is strong economic growth and expectation of further 1% interest rate hike by US Fed.

In US, 10 year bond yield is trading at 7 year high of 3.21%. We also have an alternative explanation to rise in yields and this could be a “Bearish Positioning” of markets. If this hypothesis comes true, you may see surge in USD and correction in global equity markets.

Please find below change in yield on 10 year Govt bonds of few major markets.

In above scenario of rising yields across countries, RBI would be forced to increase interest rates in tomorrow’s meeting and keep pace with others.

.

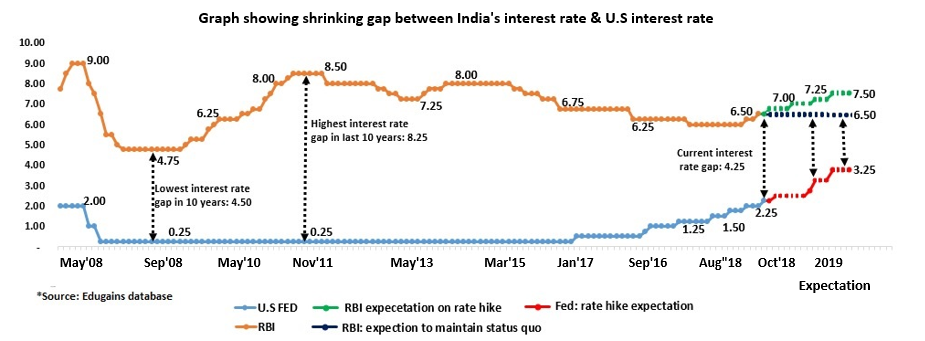

Currently, the gap between US and India interest rate is at ten year low of 4.25%. Last time similar gap was seen was in 2008 and after that RBI had to increase the rates to increase the gap and attract USD inflows. Please refer to chart below.

We feel US would increase the rate by 1% in the coming 12-18 months (shown by —— in the above chart) and RBI would be forced to do the same (shown by —— in the above chart) in order to maintain the gap between interest rates to 4.25%.

.

Tomorrow if RBI increases the rates by 0.25%, we may see more weakness in INR in coming days. An increase of 0.5% would bring some strength and such dips could be used to hedge imports.

.

It would be a difficult balancing act for RBI as increasing rate would hamper growth and not increasing would weaken rupee.

.

.

*Disclaimer: Best efforts have been made to present the analysis and data as correctly as possible. However, it is prone to errors and therefore clients are expected to do their own analysis, independent of what is shared above, before taking decisions. This is neither a solicitation nor a recommendation to Buy/Sell any currency. No representation is being made that any suggestion being made above will necessarily result into profits and principals/employees/